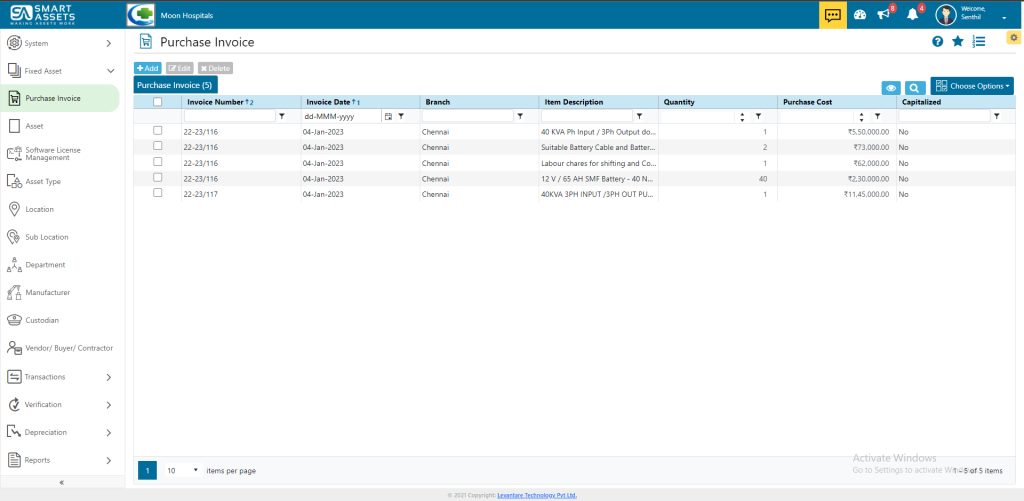

A fixed assets purchase invoice is a document that records the purchase of a fixed asset, such as land, buildings, machinery, or equipment. Unlike regular purchase invoices for consumable items, a fixed assets purchase invoice typically involves a significant amount of money and a long-term commitment from the company. Therefore, it requires more detailed information and processing.

A typical fixed assets purchase invoice includes the following information:

- Vendor information: The name and contact details of the vendor who sold the fixed asset.

- Buyer information: The name and contact details of the buyer who purchased the fixed asset.

- Invoice number: A unique identifier assigned by the vendor to the fixed assets purchase invoice.

- Invoice date: The date on which the invoice was issued by the vendor.

- Description of the fixed asset: A detailed description of the fixed asset, including its make, model, serial number, and any other relevant identification information.

- Purchase price: The amount paid for the fixed asset, including any applicable taxes or fees.

- Payment terms: The payment terms agreed upon by the vendor and the buyer, including the due date and any applicable discounts or penalties.

- Delivery information: The date of delivery or expected delivery date of the fixed asset.

- Warranty or maintenance information: Any warranty or maintenance information associated with the fixed asset, including the duration of the warranty or the maintenance terms.

Fixed assets purchase invoices are typically processed and recorded by the accounting department of the company. The information is then used to calculate the depreciation expenses for the fixed asset over its useful life, which is important for accurately reporting the company’s financial position and performance.